The dream of owning a premium German automobile – a sleek BMW, a sophisticated Mercedes-Benz, or a robust Volkswagen – has long been a aspirational goal for many Indian consumers. However, the hefty price tags, significantly influenced by taxes, import duties, and logistical costs, have historically kept these coveted vehicles out of reach for a larger segment of the market. But what if I told you that this scenario is rapidly changing? As we stand in 2026, compelling economic and policy shifts are underway that could fundamentally alter the luxury car landscape in India. We are on the cusp of a significant transformation, and I’m here to explain exactly Why cars from BMW, Mercedes and Volkswagen could soon cost less in India. This isn’t just wishful thinking; it’s a calculated projection based on tangible governmental strategies and evolving market dynamics designed to boost the Indian automotive sector and make high-end vehicles more accessible.

Key Takeaways

- Government Initiatives & Trade Agreements: New Free Trade Agreements (FTAs) and specific policies like the e-vehicle import policy are poised to reduce import duties, directly lowering the cost of imported luxury cars and components.

- Increased Localization: Major German automakers are investing heavily in local manufacturing and assembly in India, which drastically cuts down on import-related taxes and supply chain costs.

- Evolving GST Structure: While a complex topic, there’s ongoing dialogue and potential for rationalization of the Goods and Services Tax (GST) for luxury vehicles, which could provide further price relief.

- Competitive Landscape: A more affordable luxury car market will intensify competition, pushing brands to offer better value and more aggressive pricing strategies to attract a broader customer base.

- Consumer Benefit: Ultimately, these changes mean a stronger value proposition for Indian buyers, making premium German cars more attainable and accelerating market growth.

The Policy Tsunami: How Government Initiatives Are Shaping Automotive Prices

The Indian government, recognizing the immense potential of its automotive market and aiming to position India as a global manufacturing hub, has been strategically implementing policies that have a direct bearing on the cost of imported and locally assembled vehicles. The narrative around Why cars from BMW, Mercedes and Volkswagen could soon cost less in India is heavily influenced by these proactive measures, particularly in 2026.

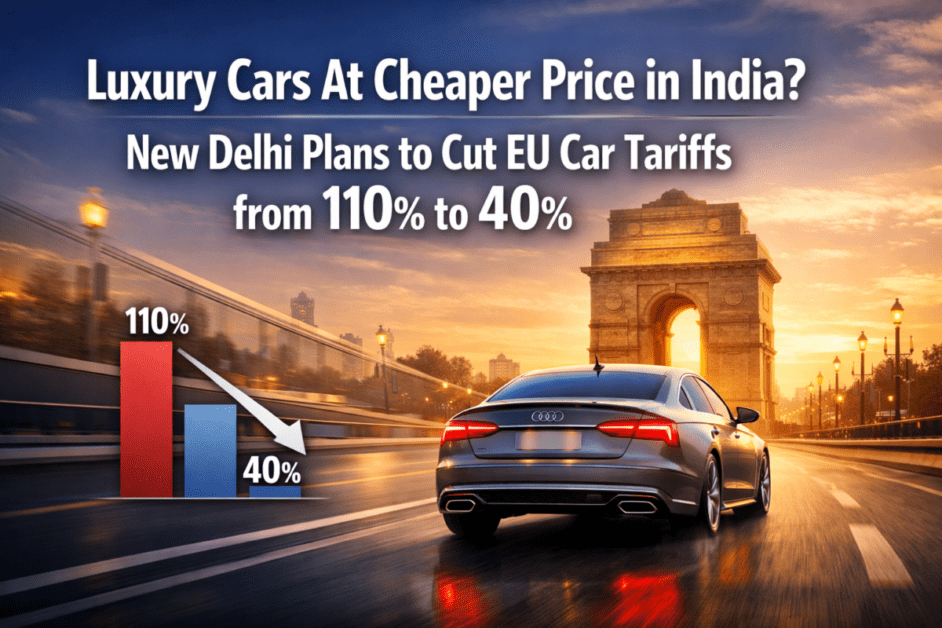

One of the most significant factors is the ongoing negotiation and implementation of Free Trade Agreements (FTAs) with key economic blocs and countries. For instance, discussions around an India-EU FTA, if concluded favorably, would dramatically reduce or even eliminate customs duties on a wide range of goods, including completely built units (CBUs) and semi-knocked-down (SKD) or completely knocked-down (CKD) kits for luxury vehicles. Currently, India imposes substantial customs duties on imported cars, which can range from 60% to 100% depending on the engine size and CIF (Cost, Insurance, Freight) value [1]. A significant reduction in these duties, even by 20-30%, would translate into considerable savings for consumers. Imagine a car that currently costs ₹1 Crore (10 million INR) purely due to duties, seeing its price drop by ₹20-30 Lakh (2-3 million INR) overnight. This is the scale of impact we are talking about.

Beyond general FTAs, the Indian government has also introduced specific policies targeting electric vehicles (EVs). The recently announced EV import policy is a game-changer. It allows manufacturers who commit to investing a minimum of $500 million in India and commence local manufacturing within three years to import a limited number of EVs at a significantly reduced customs duty of 15% (down from 70% or 100%) for vehicles with a CIF value of $35,000 and above [2]. While this policy primarily targets EVs, it sets a precedent and signals a broader shift towards incentivizing local investment and potentially lower import costs across the automotive spectrum over time. For brands like BMW and Mercedes-Benz, which have ambitious EV roadmaps, this policy immediately makes their premium electric offerings more competitive, directly answering Why cars from BMW, Mercedes and Volkswagen could soon cost less in India, especially their EV models.

- Impact of Reduced Import Duties:

- Lower MSRP: The most direct effect is a reduction in the Manufacturer’s Suggested Retail Price (MSRP) for imported cars.

- Increased Sales Volume: More attractive pricing can stimulate demand, leading to higher sales for luxury brands.

- Wider Model Availability: Brands might be encouraged to bring a broader range of international models to India if import duties are less restrictive.

- Competitive Pressure: Lower prices from one segment could put pressure on locally assembled models to also offer better value.

These policy shifts are not merely theoretical; they represent a tangible commitment by the Indian government to integrate its automotive industry more deeply into the global supply chain while also fostering domestic growth. This dual approach aims to attract foreign investment, create jobs, and offer Indian consumers a wider range of technologically advanced vehicles at more competitive prices. It’s a win-win scenario that directly addresses Why cars from BMW, Mercedes and Volkswagen could soon cost less in India.

Let’s look at a hypothetical example of duty reduction:

| Car Segment | Current Import Duty (Approx.) | Potential Reduced Duty (FTA/Policy) | Price Reduction Potential |

|---|---|---|---|

| Luxury Sedan | 60-100% | 30-50% (on CBU/CKD) | Significant (20-40% of duty component) |

| Luxury SUV | 60-100% | 30-50% (on CBU/CKD) | Significant (20-40% of duty component) |

| Premium EV | 70-100% | 15% (under new EV policy) | Drastic (potentially 50%+ of duty component) |

Note: These figures are illustrative and depend on specific agreements and vehicle classifications.

This table clearly illustrates the massive potential for price reductions, particularly for electric vehicles, under the new policies. As we at CarFatafat analyze these trends, we see a clear path towards increased affordability for premium segments. For those interested in understanding how general tax changes affect car prices, you can learn more about how 10 popular cars are getting cheaper soon due to GST.

The ‘Make in India’ Momentum: Localization as a Price Lever

While policy changes are crucial, the other major driver behind Why cars from BMW, Mercedes and Volkswagen could soon cost less in India is the sustained push towards localization. German luxury automakers are not just looking to import; they are increasingly investing in and expanding their manufacturing and assembly operations within India. This strategic pivot significantly reduces costs that are typically associated with fully imported vehicles.

When a car is imported as a Completely Built Unit (CBU), it incurs the highest customs duties. However, if a vehicle is assembled in India from Completely Knocked Down (CKD) kits or Semi Knocked Down (SKD) kits, the duties are substantially lower. Furthermore, as automakers deepen their commitment to India, they move towards sourcing more components locally. This ‘Make in India’ initiative is not just a government slogan; it’s a strategic imperative for global brands looking to thrive in a market as large and complex as India.

BMW’s Strategy: BMW India has a robust manufacturing plant in Chennai, where it assembles a significant portion of its portfolio, including popular models like the 3 Series, 5 Series, 7 Series, X1, X3, X5, and X7. By increasing the local content in these vehicles, BMW can reduce its reliance on imported parts, thereby lowering manufacturing costs and, consequently, the final sticker price. Their recent investments in local parts suppliers and increasing the depth of local assembly are clear indicators of this strategy.

Mercedes-Benz’s Approach: Mercedes-Benz India also operates a state-of-the-art manufacturing facility in Chakan, Pune, which is one of the largest luxury car manufacturing facilities in India. Models like the C-Class, E-Class, S-Class, GLC, GLE, and GLS are assembled here. Mercedes-Benz has been consistently increasing its localization levels, focusing on major components and even sophisticated parts like engines and transmissions, where feasible. This ongoing commitment to local production is a key reason Why cars from BMW, Mercedes and Volkswagen could soon cost less in India. Their approach also involves training local talent and integrating Indian suppliers into their global supply chain.

Volkswagen Group’s India 2.0 Project: The Volkswagen Group, encompassing brands like Skoda, Volkswagen, and Audi, has embarked on its ambitious “India 2.0” project. This strategy involves significant investment in a new platform (MQB A0 IN) specifically tailored for the Indian market, facilitating the production of models with high levels of localization. While Audi, as a premium brand within the VW Group, benefits from its assembly operations, the broader Volkswagen and Skoda brands are leading the charge in localization, which sets a precedent for premium segments. The success of models like the Skoda Kushaq and Volkswagen Taigun, built on this localized platform, demonstrates the feasibility and benefits of high local content. This strategic shift will eventually trickle up to their luxury offerings, paving the way for more affordable Audi, and by extension, other luxury brands under the VW umbrella, explaining another facet of Why cars from BMW, Mercedes and Volkswagen could soon cost less in India.

The Localization Advantage: A Deeper Dive

Localization brings several tangible benefits that translate into lower car prices:

- Reduced Customs Duties: As discussed, assembling vehicles from CKD/SKD kits attracts lower duties compared to CBUs. Sourcing components locally further reduces the overall import duty burden.

- Lower Logistics Costs: Transporting bulky components or fully built cars across continents is expensive. Local manufacturing significantly cuts down on international freight, warehousing, and insurance costs.

- Hedge Against Currency Fluctuations: When components are sourced locally, manufacturers are less exposed to the volatility of international currency exchange rates, leading to more stable pricing.

- Faster Production Cycles: Local manufacturing can lead to quicker production and delivery times, enabling brands to respond more agilely to market demand and potentially reduce inventory holding costs.

- Supply Chain Efficiency: Building a local supplier ecosystem fosters greater efficiency and can lead to cost optimization over time as local suppliers scale up and become more competitive.

For instance, consider the recent developments in the SUV segment. Many manufacturers are introducing new models with significant local content. For those looking at upcoming models, you might be interested in our coverage of 11 upcoming SUVs in India from 2025-2028 which will undoubtedly benefit from this localization drive. The cost advantages derived from producing key components like engines, transmissions, body panels, and interiors within India are substantial. This not only makes the final product more affordable but also allows for greater customization to suit Indian road conditions and consumer preferences.

“The shift towards ‘Make in India’ for luxury automakers is not just about compliance; it’s a profound strategic realignment to unlock the true potential of the Indian market. Local production translates directly into a better value proposition for the customer.” – Automotive Industry Analyst, 2026.

This trend is not confined to luxury cars alone. Even mass-market vehicles are experiencing price adjustments due to changes in manufacturing and taxation. For example, some popular Hyundai Creta rivals could get Rs 2.50 lakh cheaper due to various factors, including increased localization and competitive pressures. This broader market trend reinforces the idea that strategic manufacturing choices directly impact consumer prices.

GST Rationalization and Market Competition

Beyond import duties and localization, the Goods and Services Tax (GST) structure for luxury vehicles remains a hot topic, and any potential rationalization could further cement Why cars from BMW, Mercedes and Volkswagen could soon cost less in India. Currently, luxury cars attract a GST of 28%, in addition to a compensation cess that varies from 17% to 22% (for petrol/diesel cars over 1500cc and 4 meters in length) [3]. This adds up to a total tax incidence of 45-50%, making these vehicles significantly expensive.

There have been ongoing discussions within government circles and industry bodies to review the current GST slabs and cess for premium vehicles. The argument is that high taxes stifle demand and limit the growth of the luxury segment, which in turn impacts investment, job creation, and technology transfer. A more rationalized GST structure, potentially reducing the compensation cess or adjusting the 28% slab for certain categories, could provide substantial relief to consumers. Even a slight reduction in the effective GST rate by a few percentage points would translate into significant savings for high-value purchases.

- Potential Impact of GST Rationalization:

- Direct Price Reduction: A lower GST rate would immediately bring down the ex-showroom price.

- Stimulated Demand: More attractive pricing would encourage more buyers to consider luxury cars, expanding the market.

- Investment Boost: Automakers might be more inclined to invest further in India if the market size grows.

The Role of Intense Competition

The Indian automotive market is one of the most competitive globally, and the luxury segment is no exception. As vehicles from BMW, Mercedes-Benz, and Volkswagen (including Audi and Porsche) become more accessible due to the aforementioned factors, competition among these premium brands, as well as with new entrants, will intensify. This increased rivalry inherently drives down prices and encourages brands to offer more value.

- Price Wars and Discounts: When multiple players are vying for the same customer base, expect to see more aggressive pricing strategies, attractive financing options, and bundled services.

- Feature-Rich Models: To stand out, brands will likely introduce more features, advanced technology, and customization options at competitive price points.

- After-Sales Service Enhancements: Competition will also push brands to improve their after-sales service, warranty packages, and ownership experience to retain customers.

The influx of new models and technologies, including from domestic players, also adds to this competitive pressure. For instance, while BMW, Mercedes, and VW play in the premium space, the broader market is seeing exciting launches. Exploring a range of options can be done by visiting CarFatafat.

This confluence of policy incentives, localization efforts, potential GST reforms, and fierce market competition creates a powerful downward pressure on prices, making the proposition of Why cars from BMW, Mercedes and Volkswagen could soon cost less in India not just a possibility, but an increasingly likely reality in 2026 and beyond. This is great news for Indian consumers who have long aspired to own these engineering marvels.

The Broader Economic Impact and Future Outlook

The reduction in prices for luxury vehicles like those from BMW, Mercedes-Benz, and Volkswagen is not just a boon for individual consumers; it has significant broader economic implications for India. When premium cars become more affordable, it catalyzes growth across various sectors.

Firstly, it injects vitality into the automotive manufacturing ecosystem. Increased local assembly means more jobs – not just directly on the factory floor, but also in the ancillary industries that supply components, raw materials, and services. This includes everything from tire manufacturers and electronics suppliers to logistics providers and automotive software developers. The skilled workforce required for luxury car production also leads to higher-value job creation and skill development within the country.

Secondly, it attracts further foreign direct investment (FDI). When global automakers see that their products can be competitively priced and sold in India, they are more inclined to invest further in R&D, manufacturing expansion, and setting up advanced facilities. This strengthens India’s position as a global manufacturing hub and fosters a culture of innovation.

Thirdly, it helps in technology transfer. As these premium brands localize production and collaborate with Indian suppliers, advanced manufacturing processes, quality control standards, and cutting-edge automotive technologies get disseminated within the Indian industry. This elevates the overall technological prowess of the country’s manufacturing sector.

Finally, a more robust luxury car market indirectly benefits the government through increased tax revenues from higher sales volumes, despite potentially lower per-unit taxation. It also contributes to the country’s GDP growth and enhances consumer confidence. For consumers exploring their options, knowing that luxury brands are becoming more accessible might even influence purchasing decisions for other vehicle segments, perhaps leading them to consider best SUVs for highway driving or even future electric cars in India.

What Does This Mean for the Indian Consumer in 2026?

For the average Indian consumer, especially those with aspirations of owning a luxury car, the implications are profoundly positive:

- Enhanced Affordability: The most direct benefit is the increased affordability of premium German marques. What was once a distant dream might now be within tangible reach.

- Wider Choice: With competitive pricing, brands are likely to introduce more models and variants, offering a broader selection to suit diverse preferences and budgets.

- Better Value Proposition: Even if outright prices don’t drastically fall for every model, the value proposition will improve. Buyers will get more features, better technology, and superior performance for their money.

- Stronger Resale Value: A more active luxury car market often leads to better liquidity and potentially stronger resale values for these vehicles in the long run.

- Access to Cutting-Edge Technology: As luxury car prices become more competitive, more Indian consumers will gain access to the latest automotive safety, infotainment, and powertrain technologies.

This evolving landscape is truly exciting. It signals a maturation of the Indian automotive market, moving beyond just volume to embrace advanced technology and premium experiences at more accessible price points. As we observe the trends in 2026, it’s clear that the stars are aligning for a golden era of luxury car ownership in India.

Conclusion

The automotive market in India is dynamic and ever-evolving, and as we look at 2026, it’s clear that significant shifts are underway. The confluence of proactive government policies, including new Free Trade Agreements and a groundbreaking EV import policy, combined with the strategic commitment of global giants like BMW, Mercedes-Benz, and Volkswagen to increase localization, is creating a powerful force that will inevitably lead to more competitive pricing. The ongoing discussions around GST rationalization for luxury vehicles further bolster the argument for future price reductions.

These aren’t isolated events but rather part of a broader, concerted effort to integrate India more deeply into the global automotive value chain, foster domestic manufacturing, and ultimately empower the Indian consumer. The days when premium German cars were priced exorbitantly high primarily due to duties and taxes are slowly fading. We are entering an era where aspirational vehicles will become genuinely more attainable, offering a compelling blend of luxury, performance, and improved value.

Why cars from BMW, Mercedes and Volkswagen could soon cost less in India is not a question of ‘if’, but ‘when’ and ‘by how much’. For consumers contemplating a luxury vehicle purchase in the near future, staying informed about these policy changes and manufacturing shifts will be crucial. This evolving scenario promises a more vibrant, competitive, and consumer-friendly luxury automotive market in India, making the dream of owning a German luxury car a closer reality for many.

Actionable Next Steps

- Stay Informed: Keep an eye on announcements from the Indian government regarding new trade agreements and automotive policies. Follow industry news from brands like BMW, Mercedes-Benz, and Volkswagen.

- Research Upcoming Models: Many brands are launching new models or facelifts that incorporate increased localization. Research these upcoming vehicles for potential value propositions. CarFatafat provides updates on the best cars in India and various segments.

- Track Price Trends: Monitor the official websites and dealerships of these brands for any price adjustments or special offers that emerge as these policy changes take effect.

- Consider EVs: If an EV fits your needs, pay close attention to the new EV import policy, as it offers the most immediate and significant duty reductions for high-value electric vehicles.

- Engage with Dealerships: Start conversations with sales representatives at BMW, Mercedes-Benz, and Volkswagen dealerships to understand their insights on future pricing and upcoming localized models.

References

[1] Press Information Bureau, Government of India. (Varies based on specific announcements; reference to general customs duty structure).

[2] Ministry of Commerce & Industry, Government of India. (March 2024). Press Note on Scheme for promoting manufacturing of Electric Vehicles (EVs).

[3] Goods and Services Tax Council, Government of India. (Varies based on specific council meetings and notifications).