Imagine a world where your dream of owning a premium European car like a Volkswagen, BMW, or Mercedes-Benz becomes significantly more attainable. This isn’t a distant fantasy, but a real possibility on the horizon for Indian consumers in 2026. The whispers circulating the automotive industry are growing louder: Volkswagen, BMW and Mercedes cars could get cheaper as India plans EU tariff cuts. This potential shift, stemming from ongoing Free Trade Agreement (FTA) negotiations between India and the European Union, stands to revolutionize the luxury car market, making these coveted vehicles more accessible to a broader demographic. As an expert SEO content strategist and senior editor, I’m here to unpack the immense implications of this development, detailing how reduced import duties could reshape the Indian automotive landscape.

Key Takeaways

- Significant Price Reductions: Anticipate substantial price drops for imported Volkswagen, BMW, and Mercedes-Benz vehicles in India due to planned EU tariff cuts.

- Boost for Luxury Market: These reductions are expected to significantly boost the sales volume of European luxury cars, making them more competitive against domestic and other imported brands.

- Enhanced Consumer Choice: Indian buyers will gain access to a wider range of premium models at more attractive prices, increasing their purchasing power and options.

- Strategic Economic Impact: The tariff cuts are part of a broader EU-India FTA, signaling a deeper economic partnership and potentially encouraging more foreign investment in India’s automotive sector.

- Timeline and Implementation: While negotiations are ongoing, the industry expects tangible price changes to materialize in 2026, contingent on the successful conclusion and implementation of the FTA.

Understanding the Impending Shift: Why Volkswagen, BMW and Mercedes Cars Could Get Cheaper as India Plans EU Tariff Cuts

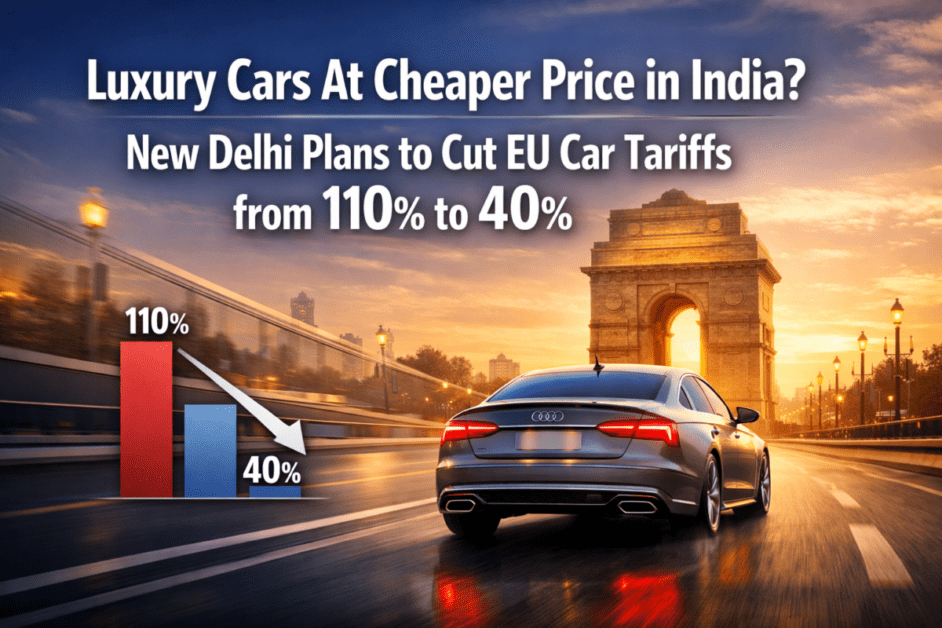

The Indian automotive market has always been characterized by its unique blend of demand for affordable, fuel-efficient vehicles and a burgeoning appetite for luxury. However, high import tariffs have historically placed European luxury cars squarely in the realm of the elite. Currently, India levies import duties as high as 100% on fully imported cars (Completely Built Units or CBUs) with an engine size greater than 3,000cc for petrol and 2,500cc for diesel, and a customs value of over US$40,000 [1]. For vehicles below these thresholds, the duty stands at 60%. These steep duties have significantly inflated the final price tags of premium brands, often doubling their cost compared to international markets.

The ongoing Free Trade Agreement (FTA) discussions between India and the European Union (EU) aim to dismantle some of these protectionist barriers. India, as part of its strategy to deepen economic ties with major global economies, is reportedly considering significant cuts to these automotive tariffs. This move is a crucial component of the broader trade deal, which seeks to boost bilateral trade and investment. If these negotiations conclude successfully, and many industry insiders are optimistic, the direct beneficiaries will be European automakers and, more importantly, Indian consumers.

The Role of Tariffs in Car Pricing

To truly grasp the impact, let’s break down how tariffs affect car prices. Imagine a BMW X5 that costs €60,000 (approximately ₹53 lakh) in Germany. When imported into India as a CBU, it faces an import duty of 100% (if it meets the criteria), instantly pushing its cost to ₹1.06 crore before adding GST, registration, and other local taxes and dealer margins. This is a dramatic increase. If India were to reduce these tariffs, say, to 30% or 15% as part of the EU FTA, the initial landed cost would plummet.

| Component | Current Scenario (100% CBU Duty) | Proposed Scenario (e.g., 30% CBU Duty) |

|---|---|---|

| Base Price (ex-factory, EU) | ₹53,00,000 | ₹53,00,000 |

| Import Duty | ₹53,00,000 (100%) | ₹15,90,000 (30%) |

| Landed Cost (pre-GST) | ₹1,06,00,000 | ₹68,90,000 |

| GST (28% + Cess) | ~₹35,00,000 | ~₹22,00,000 |

| Total Price (approx.) | ₹1,41,00,000 | ₹90,90,000 |

Note: Figures are illustrative and exclude other local taxes, logistics, and dealer margins.

As you can see from this simplified table, the potential savings are immense. A car that previously cost ₹1.41 crore could, in theory, become available for under ₹1 crore. This kind of price adjustment is exactly why the phrase “Volkswagen, BMW and Mercedes cars could get cheaper as India plans EU tariff cuts” is generating so much excitement.

Broader Economic and Geopolitical Context

The move to cut tariffs isn’t just about making luxury cars affordable; it’s a strategic play. India is keen to attract foreign investment and become a global manufacturing hub. By offering easier market access, it incentivizes European companies not only to export but potentially to invest more in local manufacturing and assembly operations. This creates jobs, transfers technology, and boosts India’s industrial capabilities.

From the EU’s perspective, securing better access to India’s vast and growing consumer market is a top priority. India represents a significant opportunity for European businesses, especially in sectors like automotive, which face intense competition globally. An FTA would streamline trade, reduce bureaucratic hurdles, and offer a level playing field for European exports. This mutual benefit is the driving force behind the negotiations.

Furthermore, the timing in 2026 is crucial. As global supply chains continue to evolve and diversify, robust trade partnerships become even more critical. An EU-India FTA sends a strong signal of commitment to open trade and multilateralism. This could also pave the way for other nations to re-evaluate their trade policies with India, potentially leading to a broader liberalization of the Indian market.

The Ripple Effect: How India’s EU Tariff Cuts Will Reshape the Luxury Car Segment

The prospect that Volkswagen, BMW and Mercedes cars could get cheaper as India plans EU tariff cuts is more than just a headline; it’s a potential catalyst for a seismic shift in the Indian luxury automotive market. The ripple effects will be felt across consumer behavior, competitive dynamics, and even local manufacturing strategies.

Increased Accessibility and Market Growth

The most immediate and apparent impact will be increased accessibility. Historically, the Indian luxury car market has been relatively small compared to its global counterparts, largely due to price sensitivity exacerbated by high tariffs. Lower prices mean a larger pool of potential buyers will find these cars within their reach. This includes:

- Affluent Middle Class: A segment that aspired to own a luxury car but found the price prohibitive will now have more options.

- Upgraders: Existing premium segment owners (e.g., those with top-end sedans or SUVs from brands like Skoda or Hyundai) might now consider upgrading to an entry-level BMW, Mercedes, or Audi.

- Younger Buyers: With luxury cars becoming more affordable, younger professionals and entrepreneurs could enter the luxury segment earlier in their careers.

This expansion of the buyer base is expected to drive significant market growth. Brands like Volkswagen (especially its premium offerings like the Tiguan and upcoming electric vehicles), BMW, and Mercedes-Benz could see substantial increases in sales volumes. This growth would attract further investment from these brands into their Indian operations, improving sales networks, service quality, and even localized product offerings.

Intensified Competition and Strategic Adjustments

While beneficial for consumers, the tariff cuts will undoubtedly intensify competition within the luxury segment. The primary contenders, BMW, Mercedes-Benz, Audi, and Volvo, will all be operating on a more level playing field in terms of import costs. This could lead to:

- Aggressive Pricing Strategies: Brands might engage in more competitive pricing to capture market share, potentially passing on even more savings to consumers beyond the tariff reduction.

- Expanded Product Portfolios: With lower import costs, automakers might consider bringing a wider range of models to India that were previously unviable due to their high price points. This includes niche models, performance variants, and even more electric vehicle (EV) options. We already see a growing interest in best EV cars in India, and tariff cuts would only accelerate this trend for luxury EVs.

- Focus on Value Propositions: Beyond price, brands will need to differentiate themselves through superior service, technology, brand experience, and after-sales support to stand out.

It’s not just European luxury brands that will feel the heat. Other premium automakers from Japan (like Lexus) and even top-end models from mass-market brands might face increased pressure as European luxury becomes more attractive. For instance, those considering a high-end SUV in the ₹40-60 lakh segment might suddenly find a entry-level Mercedes GLC or a BMW X1 a more compelling choice if prices drop significantly. This could also impact segments currently dominated by locally assembled premium vehicles, forcing them to re-evaluate their pricing and feature sets.

Impact on Local Manufacturing and Assembly

The relationship between tariff cuts and local manufacturing is complex. While reduced import duties might initially favor CBUs, the broader goal of the FTA is to facilitate trade and investment. For luxury automakers, local assembly (CKD – Completely Knocked Down units) has been a crucial strategy to mitigate high import duties. Many BMW, Mercedes-Benz, and Audi models are already assembled in India.

With tariff cuts, some brands might find it more cost-effective to import certain niche models as CBUs, reducing the need for local assembly for those specific vehicles. However, for higher-volume models, local assembly still offers significant advantages:

- Cost Efficiency: Even with lower CBU tariffs, CKD operations often provide better overall cost structures due to lower duties on parts and components, logistics savings, and potential local incentives.

- Customization: Local assembly allows for greater flexibility in customizing vehicles to Indian market preferences and conditions.

- ‘Make in India’ Initiative: Adhering to the government’s ‘Make in India’ policy can bring other benefits and goodwill, fostering a stronger local presence.

- Supply Chain Resilience: Local production reduces reliance on international shipping and makes the supply chain more robust against global disruptions.

Therefore, rather than abandoning local assembly, we might see a more strategic blend. Companies could continue to assemble their core, high-volume models locally while importing a wider array of specialized or performance-oriented models as CBUs. This dual approach would maximize market penetration and profitability. The focus could also shift to increasing localization of parts and components within India to further reduce costs, mirroring trends seen with other automakers, as highlighted in articles about upcoming SUVs in India 2025-2028 and new launches from brands like Tata and Hyundai.

Consumer Sentiment and Market Dynamics in 2026

The year 2026 will be a pivotal year for the Indian luxury car market if these tariff reductions come into effect. Consumer sentiment is likely to be overwhelmingly positive. The aspirational value of owning a Volkswagen, BMW, or Mercedes-Benz is incredibly high in India, and making these brands more accessible will tap into a deep vein of desire.

We might see:

- Increased Footfall in Showrooms: More potential buyers will visit dealerships to explore options.

- Stronger Sales Figures: Expect significant spikes in sales for the affected brands.

- Growth in Pre-Owned Luxury Market: As more new luxury cars are sold, the secondary market for pre-owned luxury vehicles will also expand, offering even more affordable entry points into premium ownership. This will be a boon for those looking for best second-hand cars India.

- New Financing Options: Banks and financial institutions might introduce more attractive loan products tailored for luxury car purchases, further facilitating sales.

The overall impact on the automotive industry will be one of dynamism and growth within the luxury segment. This will not only benefit the European automakers but also associated industries such as automotive components, service centers, insurance providers (e.g., best car insurance in India), and even car accessory businesses. The entire ecosystem stands to gain from this strategic liberalization of trade.

What it Means for Your Next Car Purchase in 2026

For any prospective car buyer in India, especially those with their sights set on premium European engineering, the news that Volkswagen, BMW and Mercedes cars could get cheaper as India plans EU tariff cuts is incredibly exciting. It means a potential recalibration of your budget and expectations for your next vehicle purchase.

Re-evaluating Your Options

If you’ve been eyeing a high-end variant of a mass-market car or an entry-level luxury vehicle, 2026 could present an opportunity to leapfrog into a more prestigious segment. For instance, someone considering a fully loaded Hyundai Creta or a Kia Seltos, which might currently cost upwards of ₹20-25 lakh, might find that with reduced tariffs, a base model BMW 1-Series (if re-introduced) or a Mercedes-Benz A-Class sedan becomes a viable option. Even for those looking at popular mid-size SUVs, the landscape changes significantly. Imagine a scenario where 3 Hyundai Creta rivals get ₹2.50L cheaper – now imagine a luxury car joining that list!

The current price ladder might get compressed, allowing you to access higher segments for the same budget. It’s crucial to follow the news on the EU-India FTA closely through reliable automotive news sources like Carfatafat.com to understand the exact reductions and their application.

The Aspirational Factor

Owning a BMW, Mercedes, or Volkswagen carries significant aspirational value. These brands are synonymous with engineering excellence, safety, luxury, and performance. Making them more affordable democratizes this aspiration. It’s not just about the vehicle itself, but the experience, the status, and the driving pleasure that comes with it.

Consider the BMW car top model – while the absolute top-tier might still be a significant investment, entry into the BMW ecosystem through more affordable models will be easier. This creates brand loyalty and a pathway for future upgrades within the same brand.

Considerations Beyond Price

While price is a major factor, prospective buyers should also consider other aspects when luxury cars get cheaper:

- Maintenance Costs: While the initial purchase price may drop, maintenance, service, and spare parts for luxury cars typically remain higher than for mass-market vehicles. Factor these into your long-term budget.

- Insurance: Premium cars often command higher insurance premiums. Research best car insurance in India that specifically caters to luxury vehicles.

- Resale Value: A larger volume of sales could impact the resale value of existing and new luxury cars. It’s a dynamic market that will need careful observation.

- Fuel Efficiency: While some luxury cars are fuel-efficient, many prioritize performance. Consider your driving needs and fuel costs, though many luxury brands are also expanding their EV offerings. You can find out more about best fuel-efficient cars on our site.

- Features and Technology: Luxury cars come packed with advanced features and cutting-edge technology. Understand what’s important to you and which models offer the best blend of innovation and value.

The Waiting Game for 2026

The exact timing and extent of the tariff cuts are still subject to ongoing negotiations. While the expectation is that significant changes will be implemented in 2026, it’s wise for consumers to remain informed. I recommend delaying a luxury car purchase if you’re targeting a European brand, and patiently waiting for the official announcements and price revisions that will undoubtedly follow the conclusion of the EU-India FTA.

This period of anticipation offers a great opportunity to research models, compare specifications, and even test drive current offerings to get a feel for what you might want. Keep an eye on automotive news portals and official brand announcements. The potential for a “dream car” to become a “real car” in 2026 is a compelling reason to wait.

Global Precedents and India’s Trade Ambitions

India’s strategy to reduce tariffs as part of bilateral trade agreements is not new, nor is it isolated. It mirrors global trends where countries use FTAs to boost economic growth, attract investment, and integrate into global supply chains. The impending reduction in duties, which means Volkswagen, BMW and Mercedes cars could get cheaper as India plans EU tariff cuts, is a significant step in India’s broader trade ambitions.

Lessons from Previous FTAs

Historically, countries that have entered into similar FTAs have often seen a boost in trade volumes and increased consumer choices. For example, when India signed an FTA with Japan, it led to reduced duties on certain Japanese goods, albeit with more complex rules of origin for cars. Similarly, India’s recent trade agreements with Australia and the UAE also included provisions for tariff reductions on various goods.

The impact can be seen in how different car segments have evolved. For instance, the discussion around 10 popular cars getting cheaper soon due to GST highlights domestic tax reforms’ effects. International tariff cuts are an even more direct lever for imported goods. The key difference with the EU FTA, particularly for luxury cars, is the sheer scale of the potential tariff reduction on high-value items, which could lead to more dramatic price changes.

India’s Vision for Global Trade Leadership

Under its ‘Atmanirbhar Bharat’ (Self-Reliant India) initiative, India is not just looking inward but also outward, aiming to become a global economic powerhouse. Part of this vision involves strategically engaging with major economic blocs like the EU, UK, and others to forge comprehensive trade agreements. These agreements are designed to:

- Boost Exports: By gaining preferential access to new markets for Indian goods and services.

- Attract FDI: Making India a more attractive destination for foreign direct investment through a more open and predictable trade regime.

- Enhance Competitiveness: Introducing healthy competition from imported goods can spur domestic industries to innovate and become more efficient.

- Integrate into Global Supply Chains: Strengthening India’s position in the global manufacturing and trade ecosystem.

The automotive sector is a crucial component of this vision. By making it easier for brands like Volkswagen, BMW, and Mercedes-Benz to operate and sell in India, the government signals its commitment to creating a vibrant, globally integrated automotive market. This could also encourage more advanced technology transfer and best practices into the Indian automotive ecosystem, benefiting local manufacturers as well. The continuous evolution of the Indian market, with launches like the 2026 Mahindra XUV700 facelift and other biggest SUV launches this Diwali, demonstrates this dynamic environment.

The Road Ahead: Challenges and Opportunities

While the prospect of cheaper European luxury cars is exciting, the path to a finalized FTA is not without its challenges. Negotiations can be complex, involving numerous sectors beyond automotive, such as agriculture, intellectual property, and services. Each side has its own strategic interests and red lines. However, the strong political will from both India and the EU suggests a high likelihood of a successful conclusion.

For consumers and the industry, the opportunities far outweigh the challenges. The potential for Volkswagen, BMW and Mercedes cars could get cheaper as India plans EU tariff cuts represents a golden era for the Indian luxury car buyer and a significant leap forward for India’s economic integration on the global stage. It’s a testament to a growing, aspirational nation that is ready to embrace premium global brands at more accessible price points.

Conclusion

The potential for Volkswagen, BMW and Mercedes cars could get cheaper as India plans EU tariff cuts is poised to be one of the most significant developments in the Indian automotive market in 2026. This strategic move, part of a broader Free Trade Agreement between India and the European Union, promises to dismantle high import tariffs that have long made European luxury cars a distant dream for many. The ripple effects will be profound: significantly lower prices, expanded market accessibility for an aspirational Indian middle class, intensified competition within the luxury segment, and a likely strategic re-evaluation of local manufacturing and import strategies by global automakers.

For the savvy Indian consumer, this translates into an unprecedented opportunity to own a premium European vehicle, often at a price point previously unimaginable. While patience will be key as the final details of the FTA are ironed out, the anticipation for 2026 is building. This is more than just about cars getting cheaper; it’s about India’s growing economic prowess, its ambition to integrate further into the global economy, and the democratization of luxury for its discerning populace. The landscape of automotive luxury in India is on the cusp of a revolutionary transformation, making high-end German engineering a much more tangible reality.

Actionable Next Steps

- Stay Informed: Regularly check reputable automotive news sites like Carfatafat.com and official government/brand announcements for updates on the EU-India FTA and specific tariff changes.

- Research Models: Begin researching the specific Volkswagen, BMW, and Mercedes-Benz models that interest you. Understand their features, variants, and current pricing.

- Budget Reassessment: Re-evaluate your car budget in light of potential price reductions. Factor in not just the purchase price but also maintenance, insurance, and running costs.

- Consider Waiting: If your current vehicle can last another year, consider holding off on a luxury car purchase until 2026 to capitalize on potential price drops.

- Test Drive: Visit showrooms and test drive potential vehicles to experience them firsthand and solidify your preferences.

References

[1] Press Information Bureau, Government of India. “CUSTOMS DUTY ON IMPORTED CARS.” Accessed September 12, 2024. https://pib.gov.in/PressReleasePage.aspx?PRID=1810574