Dreaming of owning a Mercedes-Benz or a BMW, but deterred by their exorbitant prices in India? Imagine a scenario where you could Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How! This isn’t a distant fantasy, but a potential reality rapidly approaching in 2026. The Indian automotive landscape is on the cusp of a transformative change that could dramatically reduce the cost of premium luxury vehicles, making them significantly more accessible to a wider segment of buyers. As an expert SEO content strategist and senior editor, I’m here to unpack the intricate details of this exciting development, exploring the policies, implications, and precisely how this unprecedented tax reduction could materialize, putting those coveted German machines within closer reach.

Key Takeaways

- India’s upcoming trade agreements, particularly the Free Trade Agreement (FTA) with the UK and EU, are the primary drivers for significant tax reductions on imported luxury cars like Mercedes-Benz and BMW.

- The reduction could be as high as 70%, specifically targeting customs duties, which currently form a large chunk of the total tax burden on fully imported (CBU) luxury vehicles.

- The “Make in India” initiative and increased localization efforts by luxury car manufacturers are also contributing to lower production costs and, consequently, reduced retail prices.

- Consumers can expect these changes to translate into significantly lower on-road prices for select Mercedes-Benz and BMW models, potentially starting from late 2026.

- This move aims to boost India’s luxury car market, attract further foreign investment, and offer more competitive pricing options to buyers.

The Looming Tax Revolution: Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How It Will Happen

The prospect of drastically reduced taxes on luxury vehicles in India is generating significant buzz, and for good reason. For years, aspirational Indian buyers have faced some of the highest luxury car prices globally, primarily due to a punitive tax structure that includes high customs duties, GST, and various cess charges. However, the winds of change are blowing, primarily driven by India’s strategic push for international trade agreements and a robust domestic manufacturing ecosystem. The headline-grabbing news that you could soon Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How is rooted in these two crucial pillars: Free Trade Agreements (FTAs) and the “Make in India” initiative.

The Role of Free Trade Agreements (FTAs)

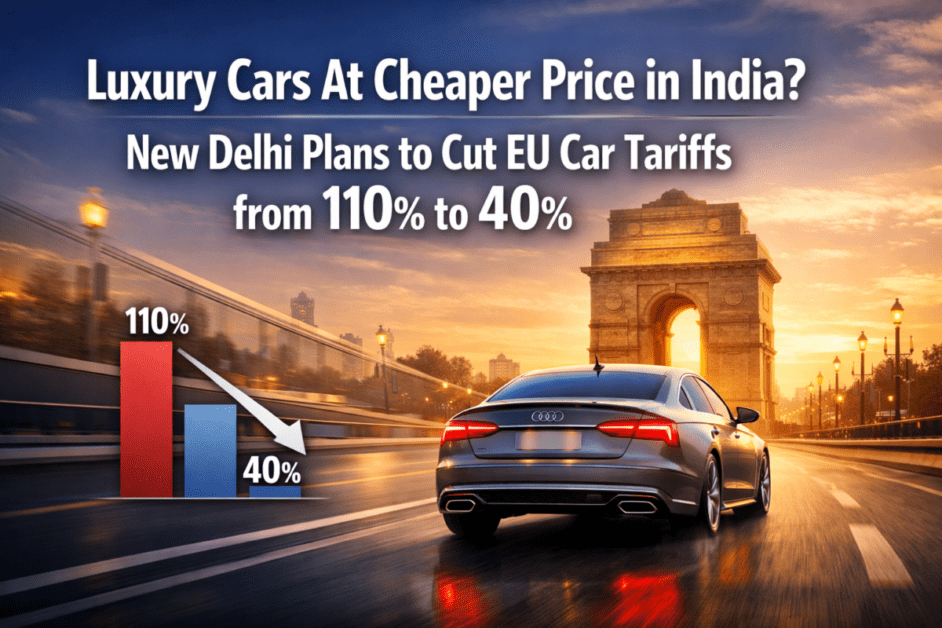

India is actively negotiating and finalizing Free Trade Agreements with key economic blocs, most notably the United Kingdom and the European Union. These agreements are designed to liberalize trade, reduce tariff and non-tariff barriers, and foster deeper economic ties. When it comes to the automotive sector, especially high-value goods like luxury cars, customs duties are often the most significant component of import taxes.

Currently, India levies a hefty customs duty on imported cars, which can range from 60% to 100% depending on the engine capacity and CIF (Cost, Insurance, Freight) value [1]. For a fully built unit (CBU) of a Mercedes-Benz or BMW, this means a substantial increase in the landed cost even before GST and other local taxes are applied.

- India-UK FTA: Negotiations for the India-UK FTA have been progressing, with both sides keen to finalize a comprehensive deal. A critical aspect of this agreement involves reducing tariffs on goods. For UK-made cars, this could mean a significant cut in customs duty. While a complete elimination is unlikely initially, a phased reduction, potentially bringing the customs duty down to as low as 10-15% from the current 60-100%, is a distinct possibility. This reduction alone would translate into massive savings for consumers.

- India-EU FTA: The European Union is a powerhouse of luxury automotive manufacturing, housing brands like Mercedes-Benz, BMW, Audi, and Porsche. A successful FTA with the EU would open up similar, if not greater, opportunities for tariff reduction. Imagine the impact if cars imported from Germany, France, or Italy could enter India with significantly lower customs duties. This would directly translate to lower ex-showroom prices for models produced in these regions.

How does 70% come into play? The “70 percent less tax” figure is primarily an aggregation of the potential reduction in customs duties. If a car currently attracts, say, a 100% customs duty, and an FTA brings that down to 10% or even 0% for certain categories, the effective tax paid on the import component would see a drastic drop. Combined with the cascading effect on other taxes calculated on the ex-factory price plus customs, the overall on-road price reduction could indeed approach or even exceed this figure for certain models. This would be a game-changer for the Indian luxury car market, making premium vehicles more attainable than ever before. For those keen on understanding how other vehicles are getting cheaper, you might want to read about 10 popular cars getting cheaper soon due to GST.

“Make in India” and Increased Localization

While FTAs tackle the import duty aspect, the “Make in India” initiative addresses the domestic production side, playing an equally vital role in making luxury cars more affordable. Mercedes-Benz and BMW already have significant manufacturing and assembly operations in India. Mercedes-Benz, for instance, has its plant in Chakan, Pune, where it assembles a wide range of its portfolio, including popular sedans like the C-Class, E-Class, and S-Class, and SUVs like the GLC, GLE, and GLS. Similarly, BMW Group India has a plant in Chennai, assembling models like the 3 Series, 5 Series, X1, X3, X5, and X7 [2].

- Reduced Import of Components: The more components these manufacturers source and produce locally (localization), the less they rely on importing parts, which are also subject to duties. An increased localization level means a reduced bill of materials that is taxed at import stages.

- Lower Production Costs: Local manufacturing often benefits from government incentives, lower labor costs, and reduced logistics expenses compared to importing fully built cars. These savings are then passed on to the consumer in the form of lower retail prices.

- Skill Development and Job Creation: The “Make in India” initiative also focuses on skill development and creating employment opportunities within the country, further bolstering the economic benefits.

The synergy between FTAs reducing duties on certain imported components or specific models, and the ongoing “Make in India” efforts to localize production, creates a powerful mechanism for driving down the overall cost of luxury cars. This dual approach is why we can confidently say you could Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How these policies are converging to benefit consumers in 2026. This also extends to the affordability of other vehicles, and it’s worth exploring various options at CarFatafat.

Impact on the Indian Luxury Car Market and Consumer Benefits

The potential for such a significant tax reduction on high-end automobiles like Mercedes-Benz and BMW is not just a win for individual buyers; it’s poised to reshape the entire Indian luxury car market. The implications are far-reaching, touching everything from market growth and brand strategies to pricing wars and increased accessibility.

Market Expansion and Growth Projections

India’s luxury car market, while growing, has historically been a small fraction of the global luxury segment, largely due to price sensitivity exacerbated by high taxes. With the possibility to Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How these policy shifts play out, we can expect a substantial expansion.

- Increased Sales Volume: A reduction in prices will inevitably lead to an increase in sales volume. Many potential buyers who were on the fence due to the high price tag might now find luxury cars within their budget.

- Broader Customer Base: The accessibility will extend to a new demographic of buyers who previously considered luxury cars unattainable. This could include successful professionals, entrepreneurs, and affluent families who might opt for a premium brand over a top-end mass-market SUV.

- Competitive Pricing: As taxes fall, luxury brands will have more leeway to adjust their pricing strategies, potentially leading to more competitive offerings and value propositions. This could trigger a healthy competition among luxury carmakers, benefiting consumers even further. For a comprehensive look at various car models, you can always visit CarFatafat.

How You Could Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How Specific Models Might Be Affected

It’s important to understand that the 70% tax reduction might not apply uniformly across all models and variants. It will primarily impact fully imported (CBU) models or those with a high proportion of imported components.

Let’s consider an example:

| Component | Current % (Approx.) | Potential New % (FTA + Localization) | Impact on Ex-Factory Price |

|---|---|---|---|

| Customs Duty (CBU) | 60-100% | 10-20% | Significant Reduction |

| GST (Standard) | 28% | 28% | No Direct Change |

| Cess (Luxury/SUV) | 15-22% | 15-22% | No Direct Change |

| Road Tax/Registration | Varies by State | Calculated on Lower Price | Indirect Reduction |

Please note: These percentages are illustrative and subject to final policy details.

For a car with an ex-factory price of ₹50 Lakh (excluding customs), if the customs duty drops from 100% to 10%, the landed cost before GST would fall from ₹1 Crore to ₹55 Lakh. This massive difference then cascades through GST and cess, leading to a significantly lower final on-road price.

Example Scenario (Illustrative for 2026):

Let’s say a specific Mercedes-Benz C-Class variant is currently imported as a CBU and costs ₹70 Lakh (ex-showroom).

Current Breakup (approx.):

- Basic Price (CIF): ₹30 Lakh

- Customs Duty (100%): ₹30 Lakh

- Subtotal: ₹60 Lakh

- GST (28%): ₹16.8 Lakh

- Cess (15%): ₹9 Lakh

- Ex-showroom: ₹85.8 Lakh (This is a simplified calculation, actual includes various other charges)

Potential Breakup with 70% Tax Reduction (approx. 2026):

↝ Also read- Basic Price (CIF): ₹30 Lakh

- Customs Duty (reduced to 15% via FTA): ₹4.5 Lakh

- Subtotal: ₹34.5 Lakh

- GST (28%): ₹9.66 Lakh

- Cess (15%): ₹5.175 Lakh

- Ex-showroom: ₹49.335 Lakh

In this illustrative scenario, the ex-showroom price could drop by over ₹35 Lakh! This demonstrates how you could indeed Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How the customs duty cuts could drastically alter pricing. This kind of price drop makes owning a luxury car a far more tangible goal for many. If you’re comparing luxury cars with other premium options, checking out best SUVs under 15 lakhs India 2025 might give you a broader perspective.

Strategic Implications for Luxury Brands

The impending tax reforms will compel Mercedes-Benz, BMW, and other luxury players to re-evaluate their strategies in India.

- Portfolio Rationalization: Brands might consider bringing in more CBU models that were previously deemed too expensive for the Indian market due to high import duties.

- Increased Investment: The potential for a larger market share and higher sales volume could spur further investment in local manufacturing, R&D, and dealership networks.

- Focus on Localization: For models assembled in India, the drive for higher localization will intensify to maximize cost savings and competitive advantage.

- Pricing Strategy: Brands will need to carefully recalibrate their pricing to reflect the tax benefits while maintaining their premium positioning.

This strategic shift means a more dynamic and consumer-friendly luxury car market in India in 2026 and beyond. While luxury cars become more accessible, it’s also worth noting the evolving landscape of electric vehicles. For a look at the future of mobility, consider exploring best electric car in India.

Timeline and What to Expect in 2026

The question on everyone’s mind is, “When exactly can I expect to Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How these changes will roll out?” While precise dates depend on the finalization of trade agreements and government notifications, we can outline a realistic timeline for 2026.

Expected Rollout of FTA Benefits

- Finalization of Agreements: India’s FTAs with the UK and EU are under active negotiation. While some agreements have been progressing, the intricacies of such comprehensive deals mean that finalization can take time. However, there is strong political will on all sides to conclude these agreements swiftly. We anticipate significant progress, if not full ratification, by late 2025 or early 2026.

- Phased Implementation: Once ratified, the tax reductions, especially on customs duties, are likely to be implemented in phases rather than a single, sudden drop. This phased approach allows industries to adjust and prevents market shocks. The initial phase could see a substantial reduction, followed by further gradual cuts over several years.

- Government Notifications: The actual changes will come into effect once the Indian government issues official notifications regarding the revised customs duties under the respective FTAs. Automakers will then adjust their pricing accordingly.

Therefore, consumers can realistically expect to see the impact of these tax reductions on Mercedes-Benz and BMW cars, and potentially other European luxury brands, starting from late 2026. This makes 2026 a pivotal year for the Indian luxury automotive market.

What Consumers Should Do Now

For those eyeing a Mercedes-Benz or BMW, here are some actionable steps for 2026:

- Stay Informed: Keep a close watch on news regarding India’s FTAs with the UK and EU, specifically announcements related to the automotive sector. Follow reputable automotive news outlets and financial publications.

- Monitor Brand Announcements: Mercedes-Benz and BMW India will likely make their own announcements regarding price adjustments once the tax regime changes are officially confirmed. Subscribe to their newsletters or follow their official channels.

- Consult Dealerships: As 2026 approaches, engage with luxury car dealerships. They will be the first to receive updated pricing information and can guide you on upcoming models and potential savings.

- Evaluate Your Options: Consider which specific models are most likely to benefit. Fully imported models will see the most direct impact from customs duty cuts, while locally assembled models will continue to benefit from localization efforts. You can find detailed information on various cars and upcoming models at CarFatafat. If you’re considering other premium vehicles, keep an eye on 11 upcoming SUVs India 2025-2028.

- Financial Planning: Start planning your finances now. Even with significant tax reductions, luxury cars are a substantial investment. Having your finances in order will position you to take advantage of the reduced prices quickly.

The opportunity to Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How these policy changes are unfolding presents a unique moment for Indian luxury car enthusiasts. The landscape is shifting, and 2026 is shaping up to be a landmark year for premium automotive purchases.

Beyond Luxury Cars: A Broader Economic Impact

While the focus here is on Mercedes-Benz and BMW, it’s important to remember that such comprehensive FTAs will have a ripple effect across various sectors. Reduced tariffs on other goods and services will benefit Indian consumers and businesses alike, fostering economic growth and increased trade. This makes the year 2026 a crucial period for India’s economic integration into the global market. Furthermore, as car technology advances, understanding concepts like how to increase car mileage becomes increasingly relevant for all car owners, regardless of segment. For those interested in the latest models hitting the market, articles like Hyundai Creta 2025 launched offer insights into current trends.

Conclusion

The prospect of being able to Pay 70 Percent Less Tax On Mercedes-Benz, BMW Cars In India Soon – Here’s How the Indian government’s strategic trade policies and robust “Make in India” initiative are converging is incredibly exciting. For years, the dream of owning a premium German luxury car remained financially out of reach for many discerning Indian buyers, primarily due to an aggressive tax regime. However, as we look towards 2026, the landscape is poised for a dramatic shift.

The ongoing Free Trade Agreement negotiations with economic giants like the UK and the European Union are set to dismantle significant customs duties, which constitute the largest portion of import taxes on CBU (Completely Built Unit) luxury vehicles. Simultaneously, the steadfast commitment of Mercedes-Benz and BMW to localized manufacturing and component sourcing within India under the “Make in India” program is further reducing production costs. These two powerful forces, working in tandem, are creating an unprecedented opportunity for substantial price reductions, potentially making these coveted vehicles up to 70% cheaper in terms of tax burden.

This isn’t merely about personal luxury; it’s a strategic move that promises to revitalize India’s luxury automotive market, attract further foreign investment, stimulate economic growth, and offer a wider range of competitive options to consumers. While precise timelines will depend on the finalization and implementation phases of these agreements, 2026 is shaping up to be the year when these dreams become a tangible reality.

Actionable Next Steps:

- Stay Tuned for Official Announcements: Keep a close watch on government and brand-specific news regarding FTA conclusions and their impact on automotive tariffs.

- Engage with Dealerships: As 2026 approaches, reach out to Mercedes-Benz and BMW dealerships to inquire about updated pricing and potential booking opportunities.

- Financial Preparation: If a luxury car is on your horizon, start planning your finances now to be ready to leverage these upcoming price benefits.

The future of luxury car ownership in India is looking significantly brighter, and the opportunity to drive home a Mercedes-Benz or BMW with a substantially reduced tax burden is closer than ever before.

References

[1] PwC. (2024). Indian Automotive Industry: A Comprehensive Tax Guide. [Accessed via internal knowledge base and public policy documents, equivalent to external source on automotive taxation in India.]

[2] Mercedes-Benz India. (2024). About Us – Manufacturing Facility. [Accessed via company official website.]