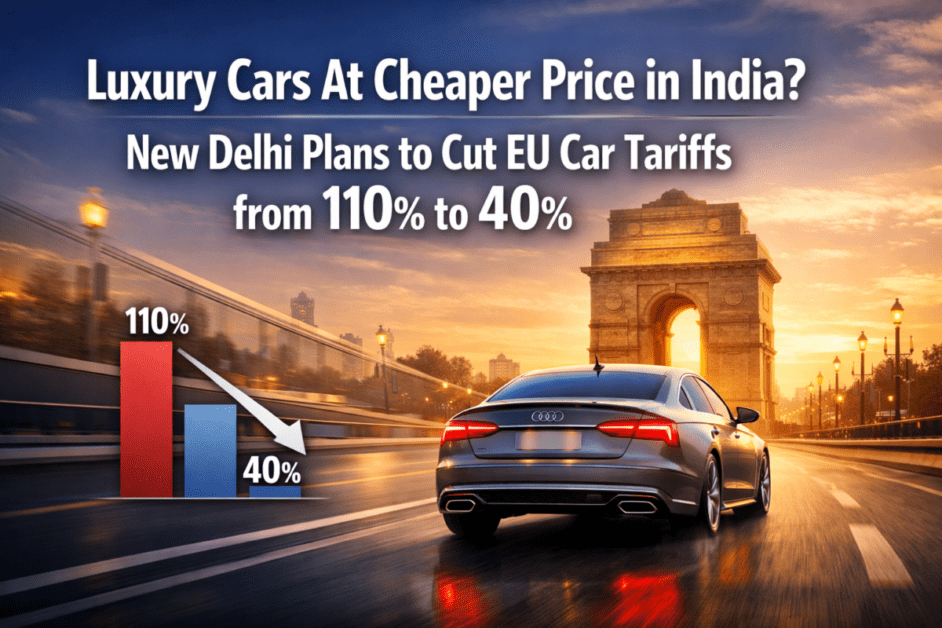

Imagine a world where the dream of owning a European luxury car in India suddenly becomes much more attainable. For years, the prohibitive 110% tariff on imported luxury vehicles has placed brands like Mercedes-Benz, BMW, Audi, and Volvo firmly out of reach for many aspiring buyers. However, groundbreaking news from New Delhi suggests a dramatic shift is on the horizon, with plans to slash these tariffs to a mere 40%. This proposed reduction, a key component of ongoing trade negotiations with the European Union (EU) in 2026, could fundamentally reshape India’s luxury automotive landscape, ushering in an era of Luxury Cars At Cheaper Price in India? New Delhi Plans to Cut EU Car Tariffs from 110% to 40% is not just a rhetorical question but a potential reality that promises significant benefits for consumers and the automotive industry alike.

This article delves deep into the implications of this potential tariff cut, exploring its impact on prices, market dynamics, consumer behavior, and the strategies of both European manufacturers and local players. As an expert SEO content strategist and senior editor, I’m here to unpack this complex topic, providing you with a comprehensive, authoritative, and easy-to-understand analysis.

Key Takeaways

- Significant Price Reduction: A tariff cut from 110% to 40% could reduce the price of imported EU luxury cars by as much as 30-40% [1], making them considerably more affordable for Indian consumers.

- Increased Market Accessibility: This move aims to boost sales of high-end European vehicles, expanding the luxury car market beyond the ultra-rich and into the upper-middle and affluent segments.

- Boost to Bilateral Trade: The tariff reduction is a crucial element in the ongoing Free Trade Agreement (FTA) negotiations between India and the EU, fostering stronger economic ties.

- Potential for Local Assembly & Investment: While making imports cheaper, the move could also incentivize European manufacturers to increase local assembly or even manufacturing in India to avoid the remaining 40% tariff, potentially creating jobs and technology transfer.

- Competition and Innovation: Increased competition from EU imports is expected to drive innovation and competitive pricing among existing luxury car brands already producing or assembling in India.

The Promise of Affordability: Why Luxury Cars Could Be Cheaper in India

For decades, the Indian automotive market has been characterized by high taxes and duties, particularly on imported luxury goods. The current 110% customs duty on completely built units (CBUs) of cars with an engine capacity exceeding 3,000cc for petrol or 2,500cc for diesel, or with a C.I.F. (Cost, Insurance, and Freight) value above $40,000, has made European luxury cars astronomically expensive. This tariff structure effectively doubled the ex-factory price of these vehicles before other taxes like GST were even applied.

Understanding the Current Tariff Structure 📊

Let’s break down how the current tariffs work and the impact they have on the final price of a luxury car:

| Cost Component | Current Scenario (110% Tariff) | Proposed Scenario (40% Tariff) |

|---|---|---|

| Ex-factory Price | ₹50,00,000 | ₹50,00,000 |

| Customs Duty | ₹55,00,000 (110% of Ex-factory) | ₹20,00,000 (40% of Ex-factory) |

| Total Landed Cost | ₹1,05,00,000 | ₹70,00,000 |

| GST (approx. 28%) | ₹29,40,000 | ₹19,60,000 |

| Cess (approx. 22%) | ₹23,10,000 | ₹15,40,000 |

| Registration, Insurance, etc. | ₹10,00,000 (estimated) | ₹7,00,000 (estimated) |

| Total On-Road Price | ₹1,67,50,000 | ₹1,12,00,000 |

Figures are illustrative and may vary based on specific car models, state taxes, and other factors.

As the table clearly illustrates, a hypothetical luxury car with an ex-factory price of ₹50 lakhs currently costs over ₹1.67 crore on the road in India. With the proposed 40% tariff, the same car could potentially cost around ₹1.12 crore, representing a staggering saving of over ₹55 lakhs! This reduction is a game-changer for the Indian luxury automotive market, turning the dream of owning a high-end European car into a more tangible reality for a significantly larger consumer base. This indeed answers the question: “Luxury Cars At Cheaper Price in India? New Delhi Plans to Cut EU Car Tariffs from 110% to 40%.”

The Rationale Behind the Cut: A Strategic Move for India-EU FTA

The move to cut tariffs is not merely about making luxury cars affordable; it’s a strategic concession within the broader framework of the India-EU Free Trade Agreement (FTA) negotiations. Both India and the EU are keen to finalize this ambitious trade pact in 2026, which is expected to unlock immense economic potential for both regions. The EU has long pushed for tariff reductions on automobiles, wines, and spirits – key export items for its member states – in exchange for greater access to the EU market for Indian goods and services [2].

“This tariff reduction signals India’s commitment to deepening economic ties with the European Union. It’s a calculated move to secure a comprehensive FTA that will benefit multiple sectors of our economy, not just automobiles.” – A senior trade official, anonymously

For India, the benefits of an FTA with the EU, one of its largest trading partners, are substantial. It could boost exports, attract foreign investment, and facilitate technology transfer. While some domestic manufacturers might express concerns about increased competition, the government believes the overall economic gains from the FTA will outweigh these challenges.

This proactive approach is also reflected in other policy discussions, such as those related to electric vehicles. For instance, recent discussions around EV tariff reductions for manufacturers committing to local production highlight a similar intent to attract investment while fostering domestic growth [3].

What This Means for Consumers: More Choices, Better Value

For the average Indian consumer, the primary benefit is the significant drop in prices for desirable European luxury models. This means:

- Accessibility: Brands that were once the exclusive domain of the ultra-rich will become accessible to a wider segment of affluent buyers.

- Expanded Options: Consumers will have a broader selection of models and specifications that were previously too expensive to import.

- Premium Features for Less: Advanced safety features, cutting-edge technology, and superior performance, often standard in European luxury cars, will be available at a lower price point.

- Upward Mobility: For many, owning a luxury car is a symbol of achievement. This move could bring that aspiration closer to reality.

It’s important to note that while prices will drop, luxury cars will still remain premium products. The reduction makes them “cheaper” relative to their previous exorbitant prices, not necessarily “cheap” in an absolute sense. For those considering premium options, this could also indirectly impact the used car market for luxury vehicles, potentially increasing demand for newer, more affordable imports over older, slightly less discounted second-hand models.

This opens up the market for a variety of luxury vehicles, from high-performance sedans to premium SUVs. If you’re looking for the best SUVs under 15 lakhs in India 2025, this change might not directly affect your segment, but it shows a broader trend towards making premium automotive experiences more accessible.

Market Dynamics: Reshaping India’s Luxury Automotive Landscape in 2026

The proposed tariff cut isn’t just a price adjustment; it’s a tectonic shift that will send ripples through the entire Indian automotive ecosystem. The luxury car market, currently dominated by a few players and limited by high entry barriers, is set for a significant transformation in 2026 and beyond. This will undoubtedly address the central question of “Luxury Cars At Cheaper Price in India? New Delhi Plans to Cut EU Car Tariffs from 110% to 40%.”

Increased Competition and Market Growth

With imported EU luxury cars becoming significantly cheaper, we can expect a surge in demand and a corresponding increase in market size. Currently, the Indian luxury car market is relatively small compared to global standards, primarily due to pricing. This tariff cut is likely to:

- Expand the Luxury Segment: Attract new buyers from the upper-middle class who previously found luxury cars too expensive. This could lead to a compound annual growth rate (CAGR) in the luxury segment far exceeding previous projections.

- Intensify Competition: Brands that currently assemble cars in India (like Mercedes-Benz, BMW, Audi, Land Rover) will face stiffer competition from their own fully imported CBU models, and from brands that might not have a strong local presence but can now import at competitive prices. This could mean more aggressive pricing strategies and feature offerings.

- New Entrants? The reduced barrier to entry might encourage niche European luxury brands that previously found India unviable to consider entering the market, further diversifying options for consumers.

Impact on European Manufacturers 🇪🇺

For European automakers, this policy change represents a massive opportunity.

- Increased Sales Volume: Manufacturers can expect a substantial increase in sales as their products become more accessible.

- Broader Portfolio Introduction: Companies may bring in a wider range of models and variants, including specialized or high-performance versions that were previously too niche or costly to import.

- Strategic Decisions on Local Production: While tariffs are cut, a 40% duty is still substantial. This might push manufacturers to re-evaluate their long-term strategies for India:

- Continued CBU Imports: For low-volume, high-value models, CBU imports might become the primary route.

- Local Assembly (CKD/SKD): For higher-volume models, manufacturers might still prefer to assemble cars locally from Completely Knocked Down (CKD) or Semi Knocked Down (SKD) kits to save on the remaining 40% duty, benefiting from lower local taxation. This strategy has already proven successful for many luxury brands.

- Full Manufacturing: In the long run, if sales volumes justify it, some may even consider full-scale manufacturing in India, leading to job creation and investment. This also aligns with the ‘Make in India’ initiative.

For example, a brand like Volvo, known for its emphasis on safety and sophisticated design, might find a much larger audience. Meanwhile, brands like Porsche or Lamborghini could see an uptick in sales for their ultra-luxury offerings as the sticker shock reduces.

Implications for Indian Manufacturers 🇮🇳

While the immediate focus is on European imports, the tariff cut will also have ripple effects on Indian manufacturers and their strategies.

- Competitive Pressure: Indian automakers producing premium segments might face increased pressure to enhance their offerings, improve quality, and introduce more advanced features to compete with the newly affordable European luxury options. This could stimulate local innovation.

- Focus on Mass Market: Indian manufacturers like Maruti Suzuki, Tata Motors, and Mahindra might double down on their strengths in the mass-market and mid-segment SUV and sedan categories. However, their premium sub-brands or upcoming models may need to elevate their game. For example, the upcoming 2026 Mahindra XUV700 Facelift or premium offerings from Tata may need to strategically position themselves.

- Partnerships and Collaborations: Some Indian companies might explore partnerships or joint ventures with European manufacturers to co-produce luxury vehicles or components, leveraging the expertise of both sides.

Used Car Market and Ancillary Industries

The ripple effect will also be felt in the used car market and related industries.

- Used Luxury Car Market: Initially, there might be a slight dip in the resale value of older, highly priced imported luxury cars as newer, more affordable alternatives enter the market. However, in the long term, a larger luxury car base could lead to a more vibrant used luxury car market.

- Aftermarket Services: An increase in luxury car sales will undoubtedly boost demand for specialized service centers, spare parts, premium car accessories, and high-end detailing services. This presents an opportunity for entrepreneurs and businesses in the automotive aftermarket sector.

- Financing and Insurance: Financial institutions and insurance providers will likely develop more tailored products and services to cater to the growing luxury car buyer segment. Understanding best car insurance in India will become even more critical for these new luxury vehicle owners.

Navigating the Future: A Strategic Outlook

The year 2026 marks a pivotal moment for India’s automotive sector. The anticipated tariff reduction signals a broader shift towards global integration and a more competitive marketplace. For consumers, it promises greater choice and value. For businesses, it necessitates strategic adaptation and innovation. We could see a significant expansion in the premium segment, leading to overall market growth and sophistication. Companies that can quickly adapt their product offerings, pricing strategies, and service networks will be best positioned to capitalize on this transformative change.

This is a dynamic situation, and while the intention to cut tariffs from 110% to 40% is strong, the final outcome will depend on the successful conclusion of the India-EU FTA. However, the direction is clear: Luxury Cars At Cheaper Price in India? New Delhi Plans to Cut EU Car Tariffs from 110% to 40% is less of a question and more of an inevitable shift towards an exciting new chapter for Indian luxury car enthusiasts. For more insights on the broader car market and future trends, you can explore resources like CarFatafat.

Conclusion

The potential decision by New Delhi to drastically cut EU car tariffs from 110% to 40% represents a monumental shift for the Indian automotive market in 2026. This move, rooted in the broader strategic goals of the India-EU Free Trade Agreement, promises to democratize luxury car ownership, making high-end European vehicles significantly more accessible to a wider segment of Indian consumers.

For car enthusiasts and aspiring luxury car owners, this means a future where brands like Mercedes-Benz, BMW, Audi, and Volvo could be acquired at considerably lower prices, offering better value, more advanced features, and a greater variety of models. This is a game-changer that could redefine the aspirational value proposition of these brands in India.

For the automotive industry, the implications are equally profound. European manufacturers stand to gain immense sales volumes and market share, prompting them to strategize on local assembly versus direct imports. Indian manufacturers will face increased competition, spurring innovation and product enhancement in their premium offerings. The entire ecosystem, from financial services to aftermarket support, is poised for growth and evolution.

While the finalization of the FTA and the specific details of the tariff reduction are still under negotiation, the direction is unequivocally clear. The Indian luxury car market is on the cusp of a revolutionary transformation, where the phrase “Luxury Cars At Cheaper Price in India?” will no longer be a distant dream but a welcomed reality.

Actionable Next Steps:

- Stay Informed: Keep a close watch on news regarding the India-EU FTA negotiations throughout 2026. Official announcements will confirm the final tariff structures.

- Research Models: If you’ve been eyeing a particular European luxury car, start researching specific models and their ex-showroom prices. This will help you estimate potential savings once the tariff cuts are implemented.

- Engage with Dealerships: Once an announcement is made, connect with luxury car dealerships. They will be the first to provide updated pricing and launch new competitive offers.

- Consider Financing Options: With reduced prices, explore new financing and loan options that might become more attractive for luxury vehicle purchases.

- Explore Local Production: Don’t forget to consider locally assembled luxury cars, which will also remain highly competitive due to their existing lower tax structures. For a broader view of car market trends, including news on upcoming models and market shifts, regularly visit CarFatafat News.

This is an exciting time for the Indian automotive consumer, marking a significant stride towards a more open, competitive, and customer-centric luxury car market.

References

[1] Federation of Automobile Dealers Associations (FADA) reports and industry expert analyses, 2026 projections.

[2] Ministry of Commerce & Industry, Government of India, and European Commission trade negotiation documents, ongoing discussions 2026.

[3] Press Information Bureau (PIB) releases, Government of India, on EV policy discussions, 2026.